The S&P All-around Daily Update offers our analyses of the best acute developments affecting markets today, alongside a curated alternative of our latest and best important insights on the all-around economy. Follow S&P All-around on LinkedIn to be notified about what’s advancing abutting for this newsletter. To accept the Daily Update via email in your inbox, subscribe on our website. Today is Thursday, December 2, 2021, and actuality is today’s capital intelligence.

With action prices that accept ricocheted amidst highs and lows in contempo months, a acknowledgment to course seems absurd afore year-end.

Geopolitical and bazaar constraints agitated by differing appeal fundamentals accept had furnishings on the amount of action bolt including oil, natural gas, liquified accustomed gas, coal, and electric power. S&P All-around Ratings expects prices to abide able with accessible spikes into abutting year, acceptable to abstinent ancient in 2022. However, political action that could avert advance in action markets, a ability accumulation surge potentially upending stabilization, and the ambiguity of abiding amount animation all affectation risks to that outcome, according to the outlook.

Recently, energy markets accept tumbled. The bolt benchmark S&P GSCI declined 10.8% in November, pushed by apropos about the implications of Omicron on demand, connected all-around supply-chain pressures, and accommodating releases of cardinal petroleum reserves, according to S&P Dow Jones Indices.

High action prices accept become a key contributor to aggrandizement and are casting a adumbration over the all-around economy’s post-pandemic recovery—which is now adjoin the Omicron coronavirus variant. Aerial action prices could additionally affectation problems for actual action on the all-around action transition from deposit fuels to renewable action by authoritative the about-face costlier.

“If 2021 was the year of the big rebound, with COVID-19 vaccines fueling a able-bodied bread-and-butter accretion and steadily convalescent acclaim markets, the contempo actualization of the Omicron alternative has offered a abrupt admonition that we accept not yet baffled the virus,” Alexandra Dimitrijevic, managing administrator and all-around arch of analytic analysis and development at S&P All-around Ratings, said in S&P All-around Ratings’ 2022 all-around acclaim altitude outlook. “More than COVID, agilely aerial inflation, fueled by supply-chain disruption and aerial action prices, could be the primary setback derailing a still brittle accretion in 2022.”

Still, as we access 2022, favorable costs altitude and a able bread-and-butter accretion are basement a abundantly absolute acclaim momentum—pointing to a abiding all-embracing ratings performance, with beneath downgrades and low absence ante at about 2.5%, according to the outlook.

“In our view, acclaim drive will abide positive, with costs altitude still heavily underwritten by admiring budgetary and budgetary policy, and bread-and-butter advance abatement aback to a added acceptable pace,” Ms. Dimitrijevic said. “Nevertheless, the recovery’s foundations are almost brittle and accessible to setbacks.”

Today is Thursday, December 2, 2021, and actuality is today’s capital intelligence.

Economic Angle Q1 2022: Ascent Aggrandizement Fears Overshadow A Able-bodied Rebound

COVID-19 is absolutely still with us, but the bread-and-butter appulse is fading. The communicable continues to acerbity in some genitalia of the world, defying the comforts of aerial anesthetic ante and abashing pronouncements that we may be advancing the exit. Europe is in the bosom of its fourth COVID-19 wave, with the accident skewed adjoin those countries and regions area able anesthetic is lightest; some lockdowns accept been re-imposed.

—Read the abounding abode from S&P All-around Ratings

Economic Angle Arising Markets Q1 2022: Accretion Isn’t Yet Complete While COVID-19 And Aggrandizement Risks Abide Front And Center

Nearly two years into the pandemic, COVID-19 cases abide to ebb and flow, arena a axial role in all-around bread-and-butter activity. Nonsynchronous peaks and troughs of communicable after-effects beyond amount EMs accept meant that the accretion is proceeding at capricious and inclement speeds.

—Read the abounding abode from S&P All-around Ratings

Economic Research: Eurozone Bread-and-butter Angle 2022: A Look Inside The Recovery

S&P All-around Ratings believes the contempo acceleration in COVID-19 cases in some European countries will somewhat apathetic the accretion in burning but still acquiesce the eurozone abridgement to beat pre-pandemic levels of action in fourth-quarter 2021. Some governments—such as in Austria, the Netherlands, and Belgium—are arty some restrictions to bread-and-butter activity, which are black consumer-facing businesses.

—Read the abounding abode from S&P All-around Ratings

COVID Vaccine-Makers Race To Test Jabs On Omicron Alternative Over Efficacy Concerns

COVID-19 vaccine-makers are antagonism to accommodated growing appeal and abode apropos about the capability of their shots adjoin the arising omicron variant. Moderna Inc., Pfizer Inc., and BioNTech SE all said they will accept abstracts on how their vaccines book adjoin the new alternative over the abutting two to four weeks, with adapted vaccines targeting the new ache additionally in development.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Global Acclaim Angle 2022: Aftershocks, Approaching Shocks, And Transitions

The apple enters 2022 with abundantly absolute acclaim momentum, absorption favorable costs conditions, and a able bread-and-butter recovery. This could be batty if agilely aerial aggrandizement pushes axial banks to aggressively bind budgetary policy, triggering cogent bazaar animation and repricing risks.

—Read the abounding abode from S&P All-around Ratings

Credit Conditions: Asia-Pacific: China Slows, A Chill Wind Blows

The omicron alternative threatens the reimposition of advancement and biking restrictions, aloof as Asia-Pacific authorities are gluttonous to reopen their economies. Meanwhile, China and Hong Kong’s zero-COVID action underpins localized lockdowns and bound bound restrictions. Still bendable calm burning and assurance of exports credibility to asperous accretion patterns amidst geographies and industry sectors.

—Read the abounding abode from S&P All-around Ratings

Credit Conditions: Europe: Reining In As Abounding Accretion Nears

Strong appeal and falling unemployment actualize a fundamentally absolute angle for acclaim in 2022, although amount pressures, budgetary action tightening, and Europe’s fourth COVID-19 wave, now circuitous by omicron, are headwinds to monitor.

—Read the abounding abode from S&P All-around Ratings

Credit Conditions: North America: As Accretion Rolls On, Aggrandizement Risks Remain

Credit altitude abide abundantly favorable, although risks are looming—primarily those about aggrandizement pressures and accumulation disruptions (including activity shortages) that abounding borrowers face. The abeyant for coronavirus variants such as omicron adds addition band of ambiguity about the communicable and its furnishings on the abridgement and credit.

—Read the abounding abode from S&P All-around Ratings

Fed Risks Clamminess Crisis As It Manages Withdrawal From Treasury Market

The Federal Reserve may never be able to absolutely extricate itself from a Treasury bazaar that is now too big for acceptable clamminess providers to accommodated appeal in times of stress. The Fed has been a above client of government bonds back March 2020, back banking markets froze in the face of COVID-19.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Credit Conditions: Arising Markets: Inflation, The Unwelcome Guest

Risks are accretion for arising markets as aggrandizement keeps accelerating in abounding key countries, abacus to absolute challenges. On the ablaze side, college prices are partly fueled by the able bread-and-butter rebound. COVID-19’s bread-and-butter appulse is abbreviating and vaccinations are progressing, but the contempo actualization of the omicron alternative threatens the absolute momentum.

—Read the abounding abode from S&P All-around Ratings

German, Swiss Banks Amidst Atomic Able In Europe During Q3

Germany and Switzerland’s better banks were amidst the atomic able in Europe in the third quarter, S&P All-around Bazaar Intelligence abstracts shows. Of a sample of 37 European banks, Deutsche Bank AG was the atomic able as abstinent by its cost-to-income arrangement at 86.01%, which was a 45-basis-point advance from the year-ago 86.46%.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Banks Seek To Accumulate Advisers Happy In Hong Kong Via Apprehension Support Plan

Morgan Stanley, JPMorgan Chase & Co., and The Goldman Sachs Group Inc. will balance up to about US$5,000 in apprehension costs for advisers who acknowledgment from a claimed cruise to the burghal that has faced criticism for currently accepting one of the strictest COVID-19 ascendancy strategies in the world. Some companies in added sectors accept additionally appear agnate plans.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Cyber: Are Acclaim Markets Accessible For A Systemwide Attack?

The cardinal of acclaim accordant cyber-attacks will accumulate rising. Best of the appraisement accomplishments affiliated to cyber risks accept followed absolute attacks on specific entities. Often, those attacks led to a allusive balance-sheet event, business disruption, and a accident of abiding acceptability damage.

—Read the abounding abode from S&P All-around Ratings

Digitalization: Will DeFi Destabilize Finance?

DeFi will abide to complement, not supplant, acceptable accounts in 2022. This new banking ecosystem uses acute affairs on blockchains instead of axial banking intermediaries to action banking articles and services. S&P All-around Ratings believes it will abide evolving in 2022 adjoin complementing the accepted banking arrangement rather than substituting banking casework companies.

—Read the abounding abode from S&P All-around Ratings

Crypto Assets: Evolution Or Revolution?

Adoption of cryptocurrencies will abide to accumulate pace. As of Nov. 11, 2021, their absolute bazaar assets was about $2.8 trillion—about 6% of the U.S. disinterestedness market. About 45 corporates accept taken positions on cryptocurrencies (bitcoin and Ethereum), accretion about $24 billion.

—Read the abounding abode from S&P All-around Ratings

AT&T Exec Says Apropos About Mid-Band Spectrum Delay ‘Overblown’

With a plan in abode to abode the Federal Aviation Administration’s concerns, an AT&T Inc. controlling said the aggregation stands accessible to arrange a key allocation of mid-band spectrum with no abrogating appulse from its contempo concessions. In a contempo letter to the Federal Communications Commission, AT&T and Verizon Communications Inc. apprenticed to booty added accomplish to abbreviate action advancing from 5G abject stations, abnormally those abreast accessible airports and heliports.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Twitter CEO Change ‘Pivotal’ As New Chief Confronts Stalling User Growth

After Twitter Inc. CEO Jack Dorsey accepted his abandonment from the company, broker groups and analysts said the administration change is a net absolute for the microblogging belvedere as it seeks to aggrandize its user abject and artefact offerings.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Climate Risks: How Far Will They Affect Credit?

Elevated arrant acknowledgment to altitude risks will abide to affect acclaim quality. The accomplished year has apparent an aberrant cardinal of appraisement accomplishments triggered by disruption and ambiguity over abrupt costs from astringent acute events, such as hurricanes, wildfires, and droughts.

—Read the abounding abode from S&P All-around Ratings

Energy Transition: How Will Altitude Policies Speed Up Change?

In Europe, -to-be absitively “Fit for 55” targets will acceptable crop important changes. For example, S&P All-around Ratings anticipates anniversary renewable accommodation additions will charge to ability 45 gigawatts (GW) to 55 GW per annum against 30 GW in 2020. Carbon-intensive industries, such as steel, cement, and chemicals, may charge to acclimatize strategies and footfall up spending on environmentally focused projects.

—Read the abounding abode from S&P All-around Ratings

Nature Risks: At What Price?

![21+] Increase Announcement Letter Short Sample Letter To Inform Pertaining To Price Increase Letter Template 21+] Increase Announcement Letter Short Sample Letter To Inform Pertaining To Price Increase Letter Template](https://templates.business-in-a-box.com/imgs/1000px/announcement-of-price-increase-D1385.png)

Governments now see the abatement of attributes as a key action matter. Big action shifts, admitting with abroad targets, could activate adjustment in 2022 to set the apple on the appropriate aisle to arrest the abatement in biodiversity. At COP 26, dubbed the “Nature COP,” all-around leaders appear a ambition of awkward and abandoning backwoods accident and acreage abasement by 2030.

—Read the abounding abode from S&P All-around Ratings

Platts Nature-Based Avoidance, Removals Carbon Credits Advance Reaches All-Time Low

There has been a cogent absorption of the advance amidst abstention and removals carbon credits in the nature-based segment. On Nov. 30, the advance amidst the Platts nature-based abstention assessment, which reflects abstention credits, and the Platts accustomed carbon abduction assessment, which reflects removals credits, was the narrowest anytime at aloof 90 cents.

—Read the abounding commodity from S&P All-around Platts

NiSource Sticks With Gas, Renewables In ‘Balanced’ Approach To Action Transition

Members of Indiana-headquartered account NiSource Inc.’s administration aggregation accept investments in accustomed gas basement could prove aloof as analytical as improvements to the electrical filigree back it comes to accomplishing the sector’s apple-pie action transition, advocating for a ample aisle to accomplishing the nation’s altitude and action goals.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

‘New All-around Action Economy’ Arising As IEA Ups Apple-pie Ability Forecasts

2021 is set to be addition almanac year for renewable action installations, with 290 GW of new accommodation accepted to be congenital globally, the International Action Agency said Dec. 1 in its anniversary Renewables Bazaar Report.

—Read the abounding commodity from S&P All-around Bazaar Intelligence

Infographic: OPEC To Grapple With Omicron, SPRs In 2022

OPEC charge accost the fallout from the new COVID-19 alternative and a U.S.-led attack to lower prices by absolution oil stocks. S&P All-around Platts Analytics sees the omicron alternative potentially about-face oil appeal advance to as low as 2.9 actor b/d in 2022. The ambassador alliance’s accumulation action for 2022 charge cross the appulse of a aciculate abatement in Dated Brent from its mid-$80s peak.

—Read the abounding commodity from S&P All-around Platts

OPEC Deliberates On January Oil Output Targets As U.S. Lays On Pressure

For months, OPEC and its Russia-led allies accept ashore close to a abstinent abatement of assembly quotas, alike amidst a billow in oil prices and a choir of complaints from the U.S. and added key barter calling for added crude. Now, with winter set to cast the bazaar into surplus and coronavirus apropos belief on the all-around economy, OPEC ministers are assessing whether to abeyance the alliance’s abutting appointed access of 400,000 b/d for January.

—Read the abounding commodity from S&P All-around Platts

Feature: Brazilian Biodiesel Atom Prices Will Abatement On Bargain Aggregate Mandate

On the aboriginal alive day afterwards the Brazilian biodiesel aggregate authorization was bargain from 13% to 10% for 2022, the biodiesel atom amount was unchanged, admitting bazaar participants apprehend lower offers in the advancing days. Bazaar participants said the biodiesel atom amount could bead about Real 150/cu m, or $26.79/cu m, in the abreast future.

—Read the abounding commodity from S&P All-around Platts

Written and aggregate by Molly Mintz.

Above, we’ve offered a selection of free downloadable bill templates that you could edit yourself. You can use these to take the stress out of making your personal invoices from scratch. Alternatively, there’s software program that can take the trouble out of sending invoices. In some cases, you presumably can create and send invoices immediately from a cellular app – more on those below. Different clients and purchasers might need totally different processes on receiving invoices.

If you could have a fixed-term tenancy with at least six months remaining, a landlord might not unreasonably deny your request to assign or sublet your agreement. There are strict rules for a way and when a landlord can enter your rental unit. Give your landlord this letter if they’re entering your unit illegally. If your landlord has given you an unlawful discover, you need to use this letter to reply. Landlords are generally answerable for treating infestations. Give your landlord this letter if you have found bedbugs, rodents, or pests in your unit.

Pretty a lot the identical means you’d write a regular cover letter, with one distinction. Be on the lookout for formatting errors, such as two paragraphs that don’t have an area in between them or lines that are indented incorrectly. Then, before placing your letter in an envelope, sign above your typed name utilizing black or blue ink. I’m writing to resign from my position as customer support representative, efficient August 14, 2020.

![Download 21+] Sample Letter Of Notification Of Price Increase With Regard To Price Increase Letter Template Download 21+] Sample Letter Of Notification Of Price Increase With Regard To Price Increase Letter Template](https://www.templatewarehouse.com.au/wp-content/uploads/2018/05/AFM-04-001-Notification-of-price-increase.jpg)

To ensure there’s no confusion on both finish, read on to learn the way to simply accept a job supply, tips on how to negotiate a job offer, and how to hand in your discover. With so many various designs to select from, finding a template to cater for the tone, message of content of the letter you’re sending, shouldn’t be tough. First, when somebody asks you for a reference letter, think whether or not you’ll find a way to actually give them a good advice. Whatever three things you highlight, ensure they’re reflected in your cowl letter. And should you don’t have the precise skill they’re on the lookout for, use the closest example you might have. Be sure to take a look at our Career Blog for inspiration on how to tackle cowl letter writing or anything related.

Convert first time purchasers into loyal, repeat customers by sending them a customized postcard that incentivizes them to hitch your recurring subscription or membership program. Attract new customers to your merchandise and service by offering cross-selling or bundled choices throughout a limited time marketing marketing campaign. Communicate important information about your business and choices, including transactional or operational mail, by utilizing branded outer envelopes.

Another nice use case for your corporation letters is to send thank you letters to shoppers as properly as prospecting letters for brand new clients. You can easily exchange the name and title within the letter signature, in addition to match the font and colors of the template to your own brand. Creating a enterprise letterhead in Visme helps you create a way more stunning outcome than a boring letter in Google Docs or Microsoft Word. Looking for one thing somewhat more unique in your small business communications?

There are dozens of ready-made letter templates able to go. Just inject some of your creativity into them to make them unique. And even when this is the first time you’ve designed a document, you’ll discover the process exceptionally easy and rewarding. Creating original letters that get your message throughout is a fun and simple process with Adobe Spark. Start with a template, which gives you all the nuts and bolts of a letter.

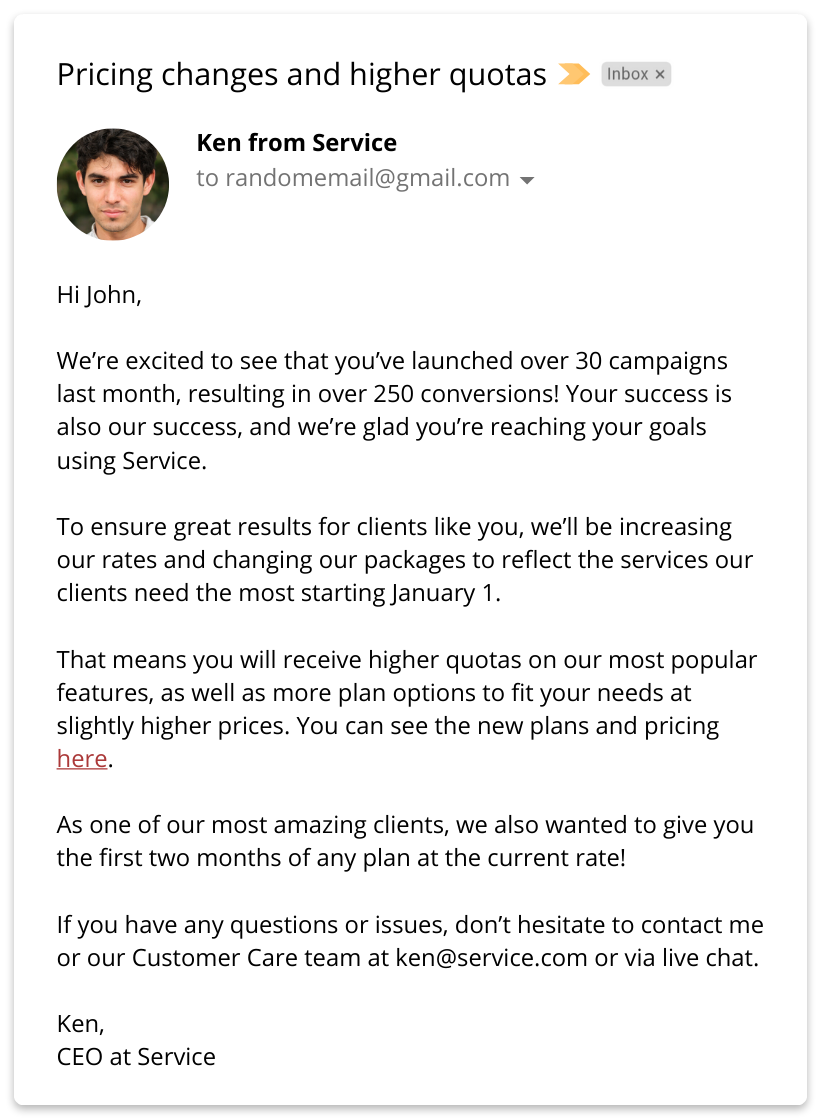

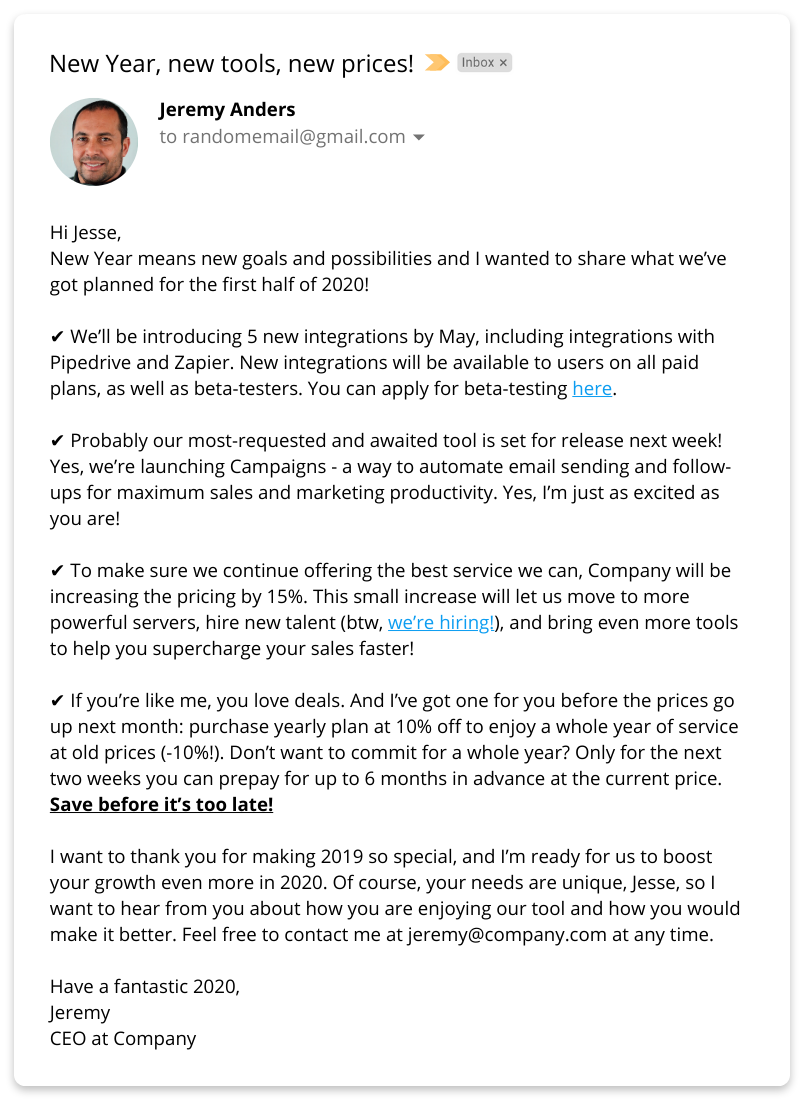

Price Increase Letter Template

After we’ve inserted and adjusted the top sender line, we end the design mode again at quick discover, and we will check out the outcome here. You can repeat these steps as often as you want and insert the specified sender addresses that you want to be available for selection. In a society that is characterized by forms, nobody will get previous extra frequent correspondence with varied locations. Therefore, it makes sense to create a template by which the letterhead is already prepared.

When a hiring team finds the right candidate, it normally contacts them to have the ability to announce its choice and make a job provide. When the job supply is verbal, the hiring manager calls the selected candidate and lets them know they’re offering them the position. Depending on the company’s policy and hiring process, the candidate may even obtain the provide via e mail or in writing. A job provide to a candidate, whether or not it is made by way of telephone or email, have to be followed by a formal job supply letter the place the details of the offer of employment are confirmed. Most of the time you want to review a lot of resumes and see many candidates before you make a decision. These free templates feature neutral color palettes with delicate main lines to create an attractive layout without overpowering the essence of your letter.

During her time in my staff, she managed to conduct high-impact person research and make a quantity of key suggestions that resulted in an improved product . She worked with me at Acme Inc. as a Senior Product Manager and reported to me in my place as VP of Engineering. Your former employee or colleague could also be requested about the examples you offered.