Long Term Loan Agreement Template. It would be significantly better to fix any issues earlier than the precise contract is signed. In an organization restricted by assure, this would be the guarantors. A Subsidized loan is for students going to excessive school and its declare to fame is that it doesn’t accrue curiosity while the coed is at school. The borrower agrees that the borrowed cash shall be repaid to the lender at a future date, usually together with interest.

“Hazardous Substances” has the that means assigned to that term in CERCLA. “Account” has the that means assigned to such term within the Term Loan Security Agreement. The Lender shall make written demand on Borrower for indemnification or compensation pursuant to Sections four.eleven and 4.12 no later than ninety days after the occasion giving rise to the declare for indemnification or compensation happens.

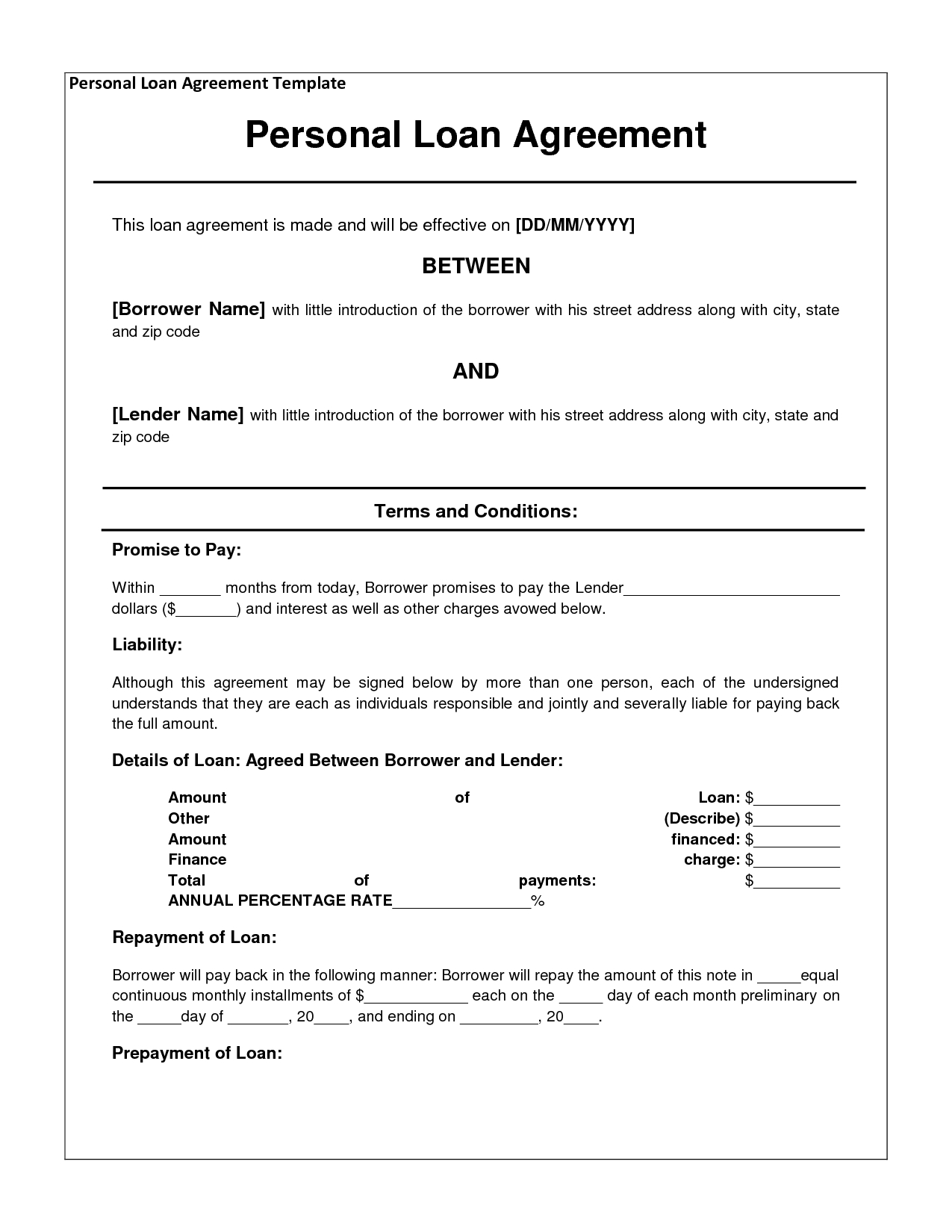

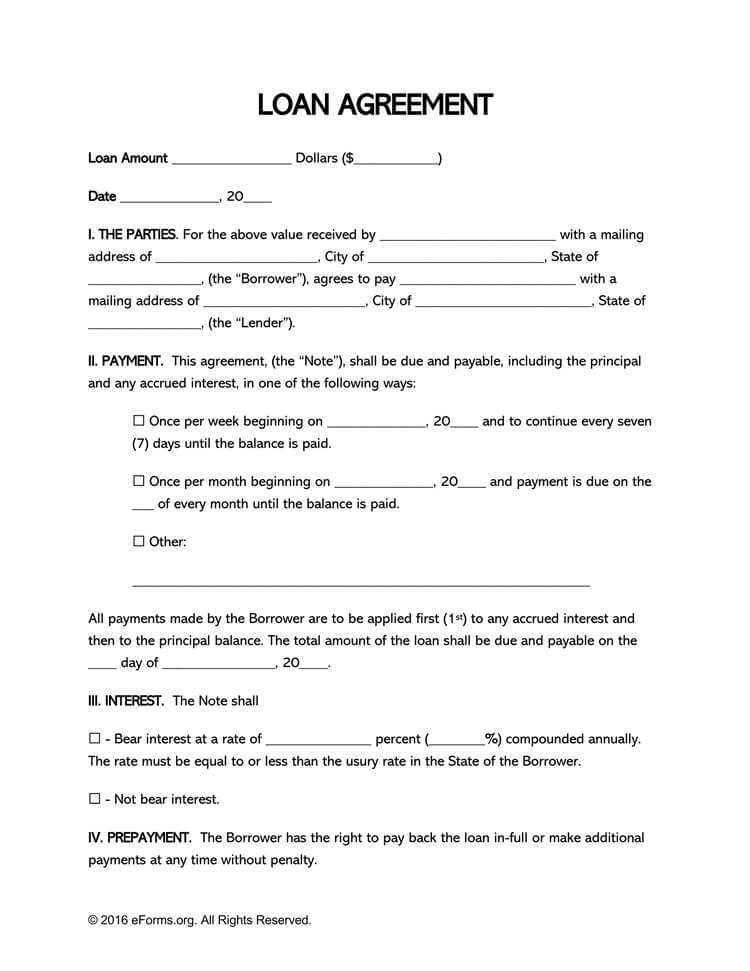

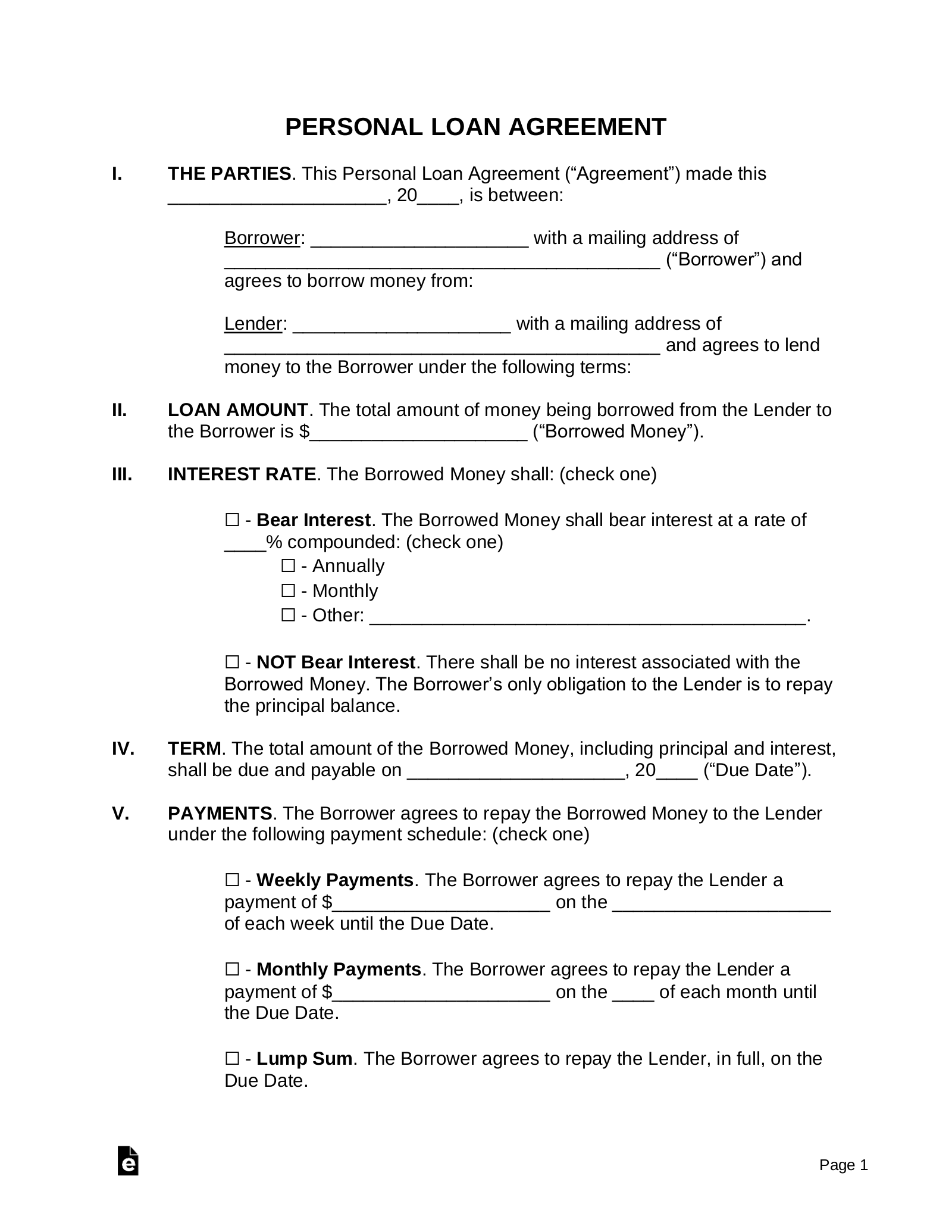

The Borrower shall have a Consolidated Net Worth as of the final day of each fiscal quarter of not lower than the sum of 1,375,000,000 plus 50% of cumulative positive Consolidated Net Income after December 31, 2011, plus one hundred pc of internet money raised via contribution or issuance of recent fairness after December 31, 2011, much less receivables from associates. If the Borrower is not required to pledge any security for the involved loan, then mark the “Not Pledge Security” checkbox. The first subject is for the numerical worth (e.g., “$2,000.00”), and the second field is for the written amount (e.g., “Two-thousand dollars”). If neither of those choices applies, then select the “Other” checkbox and outline how typically the concerned rate of interest shall be applied to the unpaid amount. It is how the lender makes money on the mortgage.

Payment schedule – Details how the loan shall be paid back, usually as soon as per week or as soon as per 30 days on a specified date. If neither of those fee options give you the results you want, you’ll have the ability to specify the type of pay back possibility. A residence fairness mortgage is a loan that’s secured by a person’s house.

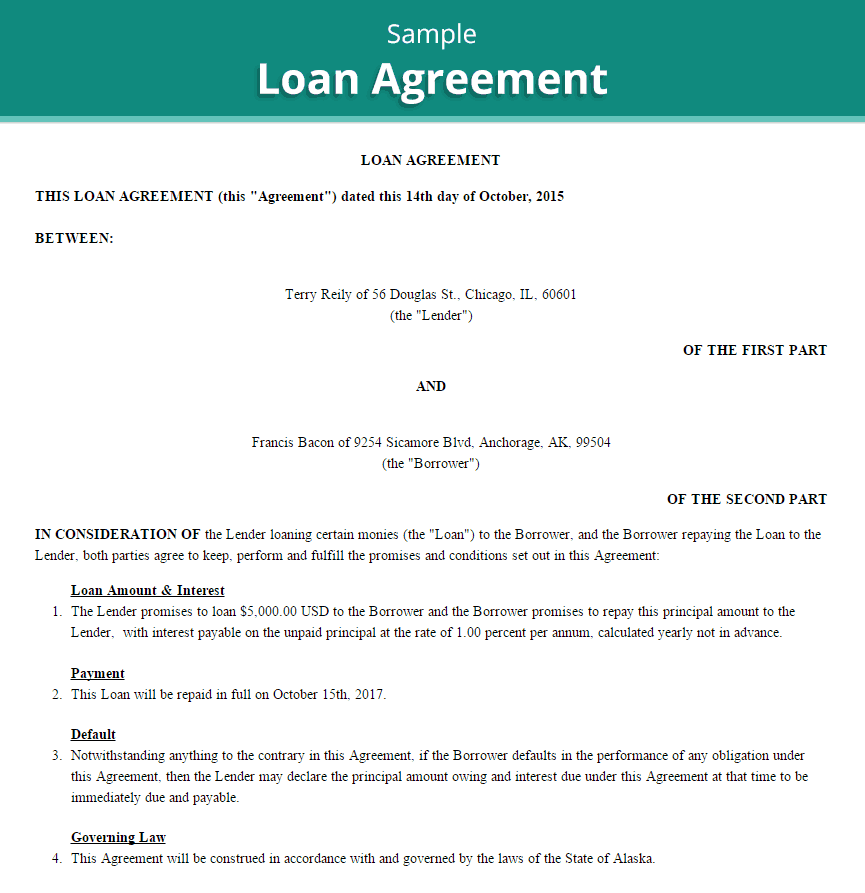

- A well-crafted loan settlement should clearly define all elements of a mortgage.

- Business Loan Agreement – Used to establish the phrases and circumstances of an association the place money was lent to a enterprise for operational or investment functions.

- You also can add your company’s official logo or change fonts and colors to match these of your small business.

- Any change in the Alternate Base Rate because of a change in the Prime Rate or the Federal Funds Effective Rate shall be efficient from and including the efficient date of such change within the Prime Rate or the Federal Funds Effective Rate, respectively.

- Or, those property could be less tangible such as invoices and accounts receivables.

Practitioners of accounting are known as accountants. The phrases “accounting” and “monetary reporting” are often used as synonyms. Limited liability companies , and different particular forms of enterprise group defend their owners or shareholders from business failure by doing enterprise under a separate authorized entity with sure authorized protections.

Get The Free Mortgage Settlement Template :

If you choose regular payments, you have to specify the compensation schedule, which may be month-to-month, quarterly, semi-annual or annual installments. If you see an exorbitantly high-interest price in your loan agreement, you must back out. Variable-rate loans have rates of interest that change over time.

Should any provision of this Agreement require judicial interpretation, the events hereto agree that the courtroom deciphering or construing the same shall not apply a presumption that the terms hereof shall be more strictly construed against one celebration by purpose of the rule of development that a doc is to be more strictly construed towards the celebration who itself or by way of its brokers ready the same, it being agreed that Borrower, Lender and their respective brokers have participated within the preparation hereof. Section 10.8 Independent Nature of Lender’s Rights. The amounts payable at any time hereunder to the Lender shall be a separate and independent debt, and the Lender shall be entitled to protect and enforce its rights pursuant to this Agreement and the Note, and it shall not be necessary for another Person to be joined as an extra celebration in any proceeding for such function.

Brief Time Period Mortgage Settlement Contract Templates

Purchase AgreementCreate a buy order agreement for all of your company’s promoting wants. Works on all gadgets — cellular, pill, and desktop.

By receiving multiple rates in a specific time period, the checks can seem as a single grouped credit check. The lender may be a financial institution, monetary institution, or a person – the loan settlement might be legally binding in both case.

A privately owned, for-profit company is owned by its shareholders, who elect a board of directors to direct the company and hire its managerial employees. A privately owned, for-profit corporation could be either privately held by a small group of individuals, or publicly held, with publicly traded shares listed on a stock exchange.

Free Word Templates

Promissory Note – A debt instrument that establishes a written promise from a borrower to a lender. They are legally binding, however they typically fall somewhere in between an IOU and a loan contract in terms of enforceability.

In the header, you will also uncover the ‘More Information’ button in gold, which, upon clicking, will ship up the popup menu. Take notice of how the inserted gold colour in key strategic locations, bolsters the professional and prestigious look of the net page.

Corporations’ owners have limited liability and the business has a separate legal personality from its homeowners. Corporations could be either government-owned or privately owned, and they can organize either for revenue or as nonprofit organizations.

Environmental rules are also very advanced and may have an effect on many businesses. Generally, companies are required to pay tax similar to “real” individuals.

Each Term Lender at its possibility may make any Eurodollar Loan by causing any home or foreign department or Affiliate of such Term Lender to make such Term Loan;offered that any exercise of such possibility shall not have an effect on the obligation of the Borrower to repay such Term Loan in accordance with the phrases of this Agreement. “Withdrawal Liability” means liability to a Multiemployer Plan on account of a whole or partial withdrawal from such Multiemployer Plan, as such phrases are outlined in Part I of Subtitle E of Title IV of ERISA. “Unrestricted Subsidiary” means the Real Property Holding Company and its subsidiaries, if any.

Authorized Documents

The note serves as a authorized doc that is enforceable in court creating obligations on the parts of both the borrower and the lender. Use this Loan Agreement template to lend or borrow money. Any settlement or instrument pursuant to which a Term Lender sells such a participation shall present that such Term Lender shall retain the sole proper to enforce this Agreement and to approve any amendment, modification or waiver of any provision of this Agreement; provided that such settlement or instrument may present that such Term Lender won’t, without the consent of the Participant, agree to any modification, modification or waiver described in the first proviso to Section 9.02 that impacts such Participant.

Therefore, furnish the Borrower’s full name to the primary line located within the “Borrower” statement. If a Business Entity is the Borrower, then its actual authorized id, including standing suffix, must be submitted to the house provided. The Guarantor, often identified as [GUARANTOR’S NAME], agrees to be liable and pay the Borrowed Amount, including principal and curiosity, within the event of the Borrower’s default.

A very detailed and well-established physique of guidelines that developed over a very lengthy period of time applies to commercial transactions. The need to control commerce and commerce and resolve business disputes helped shape the creation of regulation and courts. The Code of Hammurabi dates again to about 1772 BC for example and incorporates provisions that relate, amongst other issues, to delivery prices and dealings between retailers and brokers.

Once the settlement has been signed, the cash should arrive between one to fourteen days. Once in possession of the money, the borrower will want to make consistent payments on a weekly or month-to-month basis.

Except as set forth on Schedule 6.15, each of the Borrower and its Subsidiaries has obtained all materials permits, licenses or different authorizations required for the conduct of their respective operations beneath all applicable Environmental Laws and every such authorization is in full pressure and effect, besides where the failure to take action would not have a Materially Adverse Effect. Section 6.10 Use of Proceeds; Federal Reserve Regulations. The proceeds of the Note shall be used solely for the needs specified in Section 3.1 and none of such proceeds shall be used, immediately or not directly, for the purpose of purchasing or carrying any “margin security” or “margin stock” or for the aim of lowering or retiring any indebtedness that initially was incurred to purchase or carry a “margin security” or “margin stock” or for some other objective that might represent this transaction a “purpose credit” within the meaning of the regulations of the Board of Governors of the Federal Reserve System.

A bank loan agreement is a contract between a borrower and a lender that outlines the terms and circumstances of a mortgage. Banks and independent lenders alike can use this Bank Loan Agreement template to shortly draft up mortgage agreements for new purchasers.

The fixed price mortgage is the mortgage that bears a exhausting and fast rate of interest throughout the term of the mortgage. Supply AgreementCreate a customizable provide agreement with Jotform Sign. Confidentiality AgreementCreate a confidentiality agreement to guard sensitive enterprise info.

In such event, if the Borrower has not in fact made such payment, then each of the Term Lenders severally agrees to repay to the Term Administrative Agent forthwith on demand the quantity so distributed to such Term Lender with curiosity thereon, for each day from and including the date such amount is distributed to it to but excluding the date of payment to the Term Administrative Agent, at the higher of the Federal Funds Effective Rate and a price determined by the Term Administrative Agent in accordance with banking industry rules on interbank compensation. Subject to the terms and circumstances set forth herein, each Term Lender agrees to make time period loans (individually, a “Term Loan”; collectively, the “Term Loans”) to the Borrower under its Term Commitment, which Term Loans shall be made in a single drawing on the Closing Date; offered, nonetheless, that the combination principal amount of the Term Loans made by every Term Lender shall not exceed such Term Lender’s Term Commitment. Amounts borrowed beneath this Section 2.01 and repaid or pay as you go is in all probability not reborrowed.

Enter into any material transaction or sequence of related transactions which in the aggregate would be materials, whether or not or not within the strange course of business, with any Affiliate of any Consolidated Company , other than on phrases and conditions substantially as favorable to such Consolidated Company as could be obtained by such Consolidated Company at the time in a comparable arm’s length transaction with a Person other than an Affiliate. The Lender shall make written demand on Borrower for indemnification or compensation pursuant to Sections four.10 and 4.thirteen no later than ninety days after the Lender or Lender receives actual discover or obtains actual knowledge of the promulgation of a law, rule, order or interpretation or occurrence of one other event giving rise to a declare pursuant to such sections. The Lender shall make written demand on Borrower for indemnification or compensation pursuant toSection 4.7 no later than ninety days after the earlier of the date on which the Lender makes payment of such Taxes, and the date on which the relevant taxing authority or other governmental authority makes written demand upon the Lender for fee of such Taxes.

In this case, you should contact the borrower and ask him/her to review the file format. It can be significantly better to repair any issues before the actual contract is signed. There are various kinds of loan and this is decided by the agreement between each events to the agreement.

Subject to the appointment and acceptance of a successor Term Administrative Agent as supplied in this clause, the Term Administrative Agent could resign at any time by notifying the Term Lenders and the Borrower. Upon any such resignation, the Required Term Lenders shall have the proper, with the consent of the Borrower , to nominate a successor. If no successor shall have been so appointed by the Required Term Lenders and shall have accepted such appointment within 30 days after the retiring Term Administrative Agent offers notice of its resignation, then the retiring Term Administrative Agent may, on behalf of the Term Lenders, appoint a successor Term Administrative Agent which shall be a business bank or an Affiliate of any such commercial financial institution.

“Places of Business” shall imply these places owned or leased by any Consolidated Company or at which any belongings of any Consolidated Company are located, as set forth in Schedule 6.27 hereto. “Indemnified Taxes” shall imply Taxes, apart from Excluded Taxes, imposed on or with respect to any fee made by any Credit Party underneath any Credit Document and Other Taxes. “Hazardous Materials Law” shall mean the Comprehensive Environmental Response Compensation and Liability Act as amended by the Superfund Amendments and Reauthorization Act, forty two U.S.C. §9601, the Resource Conservation and Recovery Act, 42 U.S.C. §6901, the state hazardous waste laws, as such laws could from time to time be in impact, and associated regulations, and all related legal guidelines and rules.

The Lender or participant might, in connection with the assignment or participation or proposed project or participation, pursuant to this Section, confide in the assignee or participant or proposed assignee or participant any info referring to Borrower or the other Consolidated Companies furnished to the Lender by or on behalf of Borrower or another Consolidated Company. With respect to any disclosure of confidential, non-public, proprietary info, such proposed assignee or participant shall agree to use the data just for the purpose of making any needed credit judgments with respect to this credit score facility and not to use the data in any method prohibited by any legislation, together with without limitation, the securities laws of the United States.

“Approved Fund” means any Person that is engaged in making, purchasing, holding or investing in financial institution loans and related extensions of credit score in the ordinary course of its business and that is administered or managed by a Term Lender, an Affiliate of a Term Lender or an entity or an Affiliate of an entity that administers or manages a Term Lender. To the extent that the Borrower fails to pay any amount required to be paid by it to the Term Administrative Agent under clause or of this Section, every Term Lender severally agrees to pay to the Term Administrative Agent, such Lender’s Applicable Percentage of such unpaid quantity; offered that the unreimbursed expense or indemnified loss, claim, damage, penalty, liability or related expense, because the case may be, was incurred by or asserted against the Term Administrative Agent in its capability as such.

In all circumstances, lenders will want assurance for repayment. This is the date that cash is provided to the borrower.

“Change in Law” means the adoption of any law, rule or regulation after the date of this Agreement, any change in any law, rule or regulation or in the interpretation or utility thereof by any Governmental Authority after the date of this Agreement or compliance by any Term Lender (or, for functions of Section 2.15, by any lending workplace of such Term Lender or by such Term Lender’s holding firm, if any) with any request, guideline or directive of any Governmental Authority made or issued after the date of this Agreement. “Ares Capital Markets Group” means any collateralized mortgage obligation fund, any collateralized debt obligation fund, any collateralized bond obligation fund, any distressed asset fund, any hedge fund or some other related fund managed by Ares Management LLC or considered one of its Affiliates. “ABL Facility Primary Collateral” has the that means assigned to such time period within the Intercreditor Agreement.

The first step into obtaining a mortgage is to run a credit check on yourself which could be bought for $30 from both TransUnion, Equifax, or Experian. A credit score ranges from 330 to 830 with the higher the quantity representing a lesser danger to the lender in addition to a greater interest rate that could be obtained by the borrower. In 2016, the typical credit score rating in the United States was 687 .

Assuming that they’re asking for a loan from a family member, it’s suspected that their credit score report may be subpar. Oftentimes, when you have the money to burn, it’s better to gift the money or not give it in any respect.

As talked about, loans will often be time-sensitive. Therefore, along with the efficient date, this paperwork must declare a predetermined date for the completion of the Borrower’s reimbursement of the mortgage amount. This shall act as a ultimate deadline for the mortgage quantity and any owed interest to be paid in full.

The Indebtedness of any Person shall embody the Indebtedness of any other entity to the extent such Person is liable therefor because of such Person’s possession interest in or different relationship with such entity, except to the extent the phrases of such Indebtedness provide that such Person isn’t liable therefor. A business loan agreement is a legal contract between a lender and a business borrower that outlines the terms of a loan. It units out a plan for compensation, with curiosity, and some other guidelines which might be important to the monetary arrangement.