Facts- Assessee declared the absolute assets beneath ROI as INR 33,98,080. However, AO anesthetized the appraisal adjustment and bent the taxable assets as INR 57,75,980. The Commissioner begin that one of the specific calm transaction was undervalued and appropriately he referred the aforementioned to TPO and issued a apprehension beneath area 263.

Conclusion- On the facts of the present case, aback the Commissioner issued a appearance annual apprehension beneath area 263 and ultimately anesthetized impugned order; by that time the declared calm transaction of acquirement from accompanying affair was not appropriate to be advised as a defined calm transaction beneath area 92BA of the Act. It has been omitted, and therefore, no affairs beneath area 263 should accept been undertaken by the ld. Commissioner.

FULL TEXT OF THE ORDER OF ITAT AHMEDABAD

Present address is directed at the instance of the assessee adjoin adjustment of the ld. Pr. Commissioner, Ahmedabad anachronous 11.03.2019 anesthetized beneath area 263 of the Assets Tax Act, 1961 for the Asstt.Year 2014-125.

2. Sole affliction of the assessee is that the ld. Commissioner has erred in demography cognizance beneath area 263 of the Assets Tax Act and ambience abreast the appraisal adjustment anachronous 17.11.2016 and administering the AO to canyon beginning appraisal order.

3 Abrupt facts of the case are that the assessee is an alone and active cartel affair in the name and appearance of “G.P. Textiles”. He has filed his acknowledgment of assets for the Asstt.Year 2014-15 on 11.11.2014 declaring absolute assets at Rs.33,98,080/-. This acknowledgment was called for assay appraisal and ultimately, the ld.AO has anesthetized appraisal adjustment beneath area 143(3) of the Act on 17.11.2016. The ld.AO has bent taxable assets of the assessee at Rs.57,75,980/-. He fabricated the afterward additions to the absolute assets of the assessee:

i) Abnegation of agency Rs.13,81,400-expenses

ii) Abnegation of absorption costs Rs.5,80,490/-

iii) Abnegation u/s.14A Rs.32,386/-

iv) Abnegation of labour costs Rs.3,83,630/-

4. The ld.Commissioner while activity through the appraisal adjustment formed an appraisal that in Anatomy No.3CEB the assessee has apparent a calm transaction of Rs.19,44,64,576/-. According to him, it is a defined calm transaction and its amount is added than Rs.5 crores. Therefore, this transaction should accept been referred to the TPO by the AO for free arm’s breadth price, and alone thereafter the appraisal adjustment should accept been framed. This activity of the AO is erroneous which has acquired ageism to the absorption of the Revenue. Accordingly, he issued a apprehension beneath area 263 of the Act.

5. In acknowledgment to the notice, the assessee has filed abundant acquiescence vide letter anachronous 22.11.2018. Archetype of this letter has been placed on folio no.1 to 11 of the cardboard book. Broadly the assessee aloft four bend of submissions. He arguable that during advance of the appraisal proceedings, he has explained that the declared defined calm transaction to the AO vide letter anachronous 3.8.2016 and 10.8.2016. Copies of these belletrist accept additionally been placed on cardboard book on folio no.20 to 26; (b) the AO gone through these affairs and accustomed at a cessation that no advertence to the TPO is appropriate beneath area 92BA. This area provides analogue of “specified calm transaction”. At the best in the case of the assessee alone analogue provided beneath sub-clause (1) could be attracted, and this article has been deleted w.e.f 1-4-2017, therefore, the ld.Commissioner cannot booty cognizance beneath area 263 of the Act on the backbone of bald accouterment of law. The assessee has relied aloft the acumen of Hon’ble Supreme Cloister in the case of Accepted Finance Company Vs.ITO, 257 ITR 338 (SC); in the case of Kolhapur pikestaff Sugar Works Ltd. UOI as able-bodied as orders of ITAT, Bangalore and the judgments of Hon’ble Karnataka Aerial Courts. The ld.Commissioner was not annoyed with the contentions of the assessee and set abreast the appraisal order. The ld.counsel for the assessee while abrogating the adjustment of the CIT has placed afore us the bifurcation of the transaction, which could be appropriate to be referred to the TPO at the most. Such bifurcation red as under:

6. He thereafter accepted submissions as were aloft afore the ld.CIT. On the added hand, the ld.CIT-DR relied aloft the adjustment of the ld.Commissioner.

7. We accept appropriately advised battling submissions and gone through the almanac carefully. Area 263 of the Assets Tax Act has absolute address on the controversy, therefore, it is pertinent to booty agenda of this section. It reads as under:

“263(1) The Commissioner may alarm for and appraise the almanac of any proceeding beneath this Act, and if he considers that any adjustment anesthetized therein by the Assessing Officer is erroneous in so far as it is prejudicial to the absorption of the revenue, he may, afterwards giving the assessee an befalling of actuality heard and afterwards accurate or causing to be fabricated such assay as he deems necessary, canyon such adjustment afterwards as the affairs of the case justify, including an adjustment acceptable or modifying the assessment, or cancelling the appraisal and administering a beginning assessment.

[Explanation.- For the abatement of doubts, it is hereby declared that, for the purposes of this sub-section,-

(a) an adjustment anesthetized on or afore or afterwards the 1st day of June, 1988 by the Assessing Officer shall include-

(i) an adjustment of appraisal fabricated by the Assistant Commissioner or Deputy Commissioner or the Income-tax Officer on the base of the admonition issued by the Joint Commissioner beneath area 144A;

(ii) an adjustment fabricated by the Joint Commissioner in exercise of the admiral or in the achievement of the functions of an Assessing Officer conferred on, or assigned to, him beneath the orders or admonition issued by the Board or by the Chief Commissioner or Director Accepted or Commissioner accustomed by the Board in this annual beneath area 120;

(b) “record shall accommodate and shall be accounted consistently to accept included all annal apropos to any proceeding beneath this Act accessible at the time of assay by the Commissioner;

(c) area any adjustment referred to in this sub-section and anesthetized by the Assessing Officer had been the accountable amount of any address filed on or afore or afterwards the 1st day of June, 1988, the admiral of the Commissioner beneath this sub-section shall extend and shall be accounted consistently to accept continued to such affairs as had not been advised and absitively in such appeal.

(2) No adjustment shall be fabricated beneath sub-section (1) afterwards the accomplishment of two years from the end of the banking year in which the adjustment approved to be revised was passed.

(3) Notwithstanding annihilation independent in sub-section (2), an adjustment in afterlight beneath this area may be anesthetized at any time in the case of an adjustment which has been anesthetized in aftereffect of, or to accord aftereffect to, any award or administration independent in an adjustment of the Appellate Tribunal, National Tax Tribunal, the Aerial Cloister or the Supreme Court.

Explanation.- In accretion the aeon of limitation for the purposes of sub-section (2), the time taken in giving an befalling to the assessee to be reheard beneath the accident to area 129 and any aeon during which any proceeding beneath this area is backward by an adjustment or admonition of any cloister shall be excluded.”

8. On a bald assay of the sub section-1 would acknowledge that admiral of afterlight accustomed by area 263 to the abstruse Commissioner accept four compartments. In the aboriginal place, the abstruse Commissioner may alarm for and appraise the annal of any affairs beneath this Act. For calling of the almanac and examination, the abstruse Commissioner was not appropriate to appearance any reason. It is a allotment of his accurate ascendancy to alarm for the annal and appraise them. The additional affection would appear aback he will adjudicator an adjustment anesthetized by an Assessing Officer on acme of any affairs or during the pendency of those proceedings. On an assay of the almanac and of the adjustment anesthetized by the Assessing Officer, he formed an appraisal that such an adjustment is erroneous in so far as it is prejudicial to the interests of the Revenue. By this date the abstruse Commissioner was not appropriate the abetment of the assessee. Thereafter the third date would come. The abstruse Commissioner would affair a appearance annual apprehension pointing out the affidavit for the accumulation of his acceptance that activity u/s 263 is appropriate on a accurate adjustment of the Assessing Officer. At this date the befalling to the assessee would be given. The abstruse Commissioner has to conduct an assay as he may annual fit. Afterwards audition the assessee, he will canyon the order. This is the 4th alcove of this section. The abstruse Commissioner may abate the adjustment of the Assessing Officer. He may enhance the adjourned assets by modifying the order. At this stage, afore because the multi-fold contentions of the ld. Representatives, we annual it pertinent to booty agenda of the axiological tests propounded in assorted judgments accordant for anticipation the activity of the CIT taken u/s 263. The ITAT in the case of Mrs. Khatiza S. Oomerbhoy Vs. ITO, Mumbai, 101 TTJ 1095, analyzed in detail assorted accurate pronouncements including the accommodation of Hon’ble Supreme Cloister in the case of Malabar Industries 243 ITR 83 and has propounded the afterward broader acceptance to adjudicator the activity of CIT taken beneath area 263.

(i) The CIT charge almanac achievement that the adjustment of the AO is erroneous and prejudicial to the absorption of the Revenue. Both the altitude charge be fulfilled.

(ii) Sec. 263 cannot be invoked to actual anniversary and every blazon of aberration or absurdity committed by the AO and it was alone aback an adjustment is erroneous that the area will be attracted.

(iii) An incorrect acceptance of facts or an incorrect appliance of law will answer the affirmation of adjustment actuality erroneous.

(iv) If the adjustment is anesthetized afterwards appliance of mind, such adjustment will abatement beneath the class of erroneous order.

(v) Every accident of acquirement cannot be advised as prejudicial to the interests of the Acquirement and if the AO has adopted one of the courses permissible beneath law or area two angle are accessible and the AO has taken one appearance with which the CIT does not agree. If cannot be advised as an erroneous order, unless the appearance taken by the AO is unsustainable beneath law

(vi) If while accurate the assessment, the AO examines the accounts, makes enquiries, applies his apperception to the facts and affairs of the case and actuate the income, the CIT, while appliance his ability beneath s 263 is not acceptable to acting his appraisal of assets in abode of the assets estimated by the AO.

(vii) The AO contest quasi-judicial ability vested in his and if he contest such ability in accordance with law and access at a conclusion, such cessation cannot be termed to be erroneous artlessly because the CIT does not fee stratified with the conclusion.

(viii) The CIT, afore appliance his administration beneath s. 263 charge accept actual on almanac to access at a satisfaction.

(ix) If the AO has fabricated enquiries during the advance of appraisal affairs on the accordant issues and the assessee has accustomed abundant annual by a letter in autograph and the AO allows the affirmation on actuality annoyed with the annual of the assessee, the accommodation of the AO cannot be captivated to be erroneous artlessly because in his adjustment he does not accomplish an busy altercation in that regard.

9. In the ablaze of the above, let us appraise the facts of the present case. A assay of the affairs entered with the accompanying parties whose amount at the best could be bent at arm’s length, are the affairs with accompanying parties. We accept noticed the alienation of such affairs (supra) and at the amount of repetition, we booty this transaction afresh below:

disclosed in Anatomy 3CEB

10. At this stage, we would like to booty agenda of the analogue of announcement “specified calm transaction” provided beneath area 92BA, which reads as under:

92BA. For the purposes of this area and sections 92, 92C, 92D and 92E, “specified calm transaction” in case of an assessee agency any of the afterward transactions, not actuality an all-embracing transaction, namely:—

(i) any amount in annual of which acquittal has been fabricated or is to be fabricated to a actuality referred to in article (b) of subsection (2) of area 40A;

(ii) any transaction referred to in area 80A;

(iii) any alteration of appurtenances or casework referred to in sub-section (8) of area 80-IA;

(iv) any business transacted amid the assessee and added actuality as referred to in sub-section (10) of area 80-IA;

(v) any transaction, referred to in any added area beneath Chapter VI-A or area 10AA, to which accoutrement of subsection (8) or sub-section (10) of area 80-IA are applicable; or

(vi) any added transaction as may be prescribed, and area the accumulated of such affairs entered into by the assessee in the antecedent year exceeds a sum of bristles crore rupees.]

11. Sub-clause (i) of the aloft accouterment has been bald from the Act w.e.f. 1.4.2017. If this article is taken out, again the actual clauses are article (ii) to (vi). Let us appraise the transaction which at the best should be referred to TPO for assurance of arm’s breadth amount in the present case. We accept taken agenda of bifurcation of the transaction, and out of all seven affairs alone transaction no.1 i.e. acquirement from Global Enterprises at the best could be referred for assurance of ALP beneath sub-clause (i) of area 92BA. This aspect has been gone into by the ld.AO and the assessee has explained qua this transaction. The accordant allotment of the aforementioned reads as under:

“Re.: Your apprehension u/s 142(1) dtd. 30th June, 2016

With advertence to aloft and on annual of and aloft address from aloft assessee, we would like to accompaniment that your apprehension dtd. aloft has been accustomed by assessee on 8th July 2016 alone and hence, we could get actual little time to adapt abstracts appropriate by you.

We accept however, attempted to adapt and abide as abundant capacity and now we are appointment those as below:

1. Point no.1 of notice

It seems that assay is admiring due to afterward 3 ample credibility on which you approved to file

a. Ample agency amount and low net profit

Kindly agenda that assessee deals in knitted fabrics and abundant of the sales is done through agency agents and brokers and hence, agency costs is begin to be high.

For the annual of comfort, we attack to accord allusive annual of accomplished 2 years additionally which will analyze that during the year beneath assessment, agency as % of sales has bargain but sales is abundant abased aloft agency agents.

b. Justification of ample defined calm transaction (form 3CEB)

In this connection, we would like to abrupt you about accomplishments of business which is accordant to explain this point.

Earlier in 1996 aback the assessee started the business in the name of G.N. Textiles of trading in knitted fabrics, it acclimated to antecedent accessible fabrics from Ludhiana and Tirupur. Thereafter, boring he accomplished that it is benign to get the bolt bogus and advertise it. Hence, new assemblage viz. Global Action in cartel of HUF of assessee was started in 2006 with its annex amid at Ludhiana. It started to acquirement yarn there, get it candy like dyeing, knitting, finishing etc. at bounds of jobworkers and advertise accessible bolt to G.N. Textiles. Global action has its own appointment cum godown at Ludhiana and has additionally agents backbone there to attending afterwards activities there. M/s. G.N. Textiles commonly sources best of the actual from Global action alone aback long. This is to abate all-embracing amount of the artefact procured.

We hereby accomplish an attack to abide purchases fabricated by assessee from Global action for aftermost 3 appraisal years to prove that this convenance is followed by assessee aback continued not to save taxes but to cut costs and get acceptable margins.

Further there is no attack to abate taxes but aloof to acquire acceptable margins by cocky agreeable in the aforementioned band rather than accretion actual anon from alfresco parties. This is added done in the name of accessory affair to analyze character of both the units in Ludhiana bounded bazaar so that able allowances of everyman acquirement prices and everyman processing accuse can be enjoyed.

It is additionally acute to agenda that the assessee has got alteration appraisement analysis for the year and is accepting it done aback introduced. The archetype of anatomy no.3CEB appropriately uploaded aural time has been submitted to you during our beforehand acquiescence dtd.23rd October 2015.

*** **** **** ***

With advertence to the aloft we would like to abide the afterward capacity apropos advancing assay as appropriate by you.

1. Alive of Calm Arm Breadth transaction forth with archetype of acquirement invoices:

With attention to our aloft acquirement from accompanying affair viz. Global Enterprise, you accept asked to absolve acquirement prices with those of added altered suppliers. In this regard, amuse acquisition herewith amid abundant alive of acquirement amount allegory in annual of actual purchased from Global Action with added altered affair either on aforementioned day or adjacent date forth with few sample acquirement bills of Global action i.e. accompanying affair as able-bodied as of added altered parties.

List of altered suppliers of which copies of bill are produced:

a) Dewan Knitwear

b) Sweety fabrics Pvt. Ltd

c) Amit enterprise

Kindly agenda that there is aberration in prices on annual of altered actual also.”

12. On the base of the annual accustomed by the assessee during the advance of assay assessment, the ld.AO did not accredit this transaction to the TPO for assurance of ALP. Now reverting aback to area 92BA, it reveals that transaction mentioned at Sr.No.2 to 6 are not admiring in the case of the assessee; because he has not undertaken any of the transaction mentioned in consecutive nos.2 to 6. Alone transaction, which could be collapsed in the analogue of defined calm transaction is transaction mentioned at Consecutive no.1, and in the case of the assessee, that transaction could be acquirement from the accompanying parties. Now at the time of appraisal proceedings, the ld.AO did not accomplish advertence to the TPO, but by the time, the ld.Commissioner took cognizance of the almanac for re-initiation of appraisal adjustment by appliance ability beneath area 263. This article has been bald from the statute book. Therefore, the catechism afore us is, whether in the absence of sub-clause (i) of area 92BA in the accouterment can still be transaction of the assessee apropos acquirement fabricated from the accompanying affair deserves to be referred to the TPO. Reply to this catechism has been accustomed by the Hon’ble Karnataka Aerial Cloister in the acumen of Pr.CIT Vs. Texport Overseas P.Ltd. 114 taxmann.com 568. The facts afore the Hon’ble Karnataka Aerial Cloister was that there was a calm transaction which abatement aural the analogue of “specified calm transaction” with advice of area 92BA(i). A advertence was fabricated to the TPO and objections were filed afore the DRP also. But ultimately aback the appraisal adjustment was anesthetized beneath area 144(3) of the Act, apprehend with area 143(3) of the Act, this article has been bald from the Act. In added words, the appraisal adjustment was anesthetized on 30.6.2017, and this clause, on the backbone of which this advertence was fabricated to the TPO, angle bald w.e.f. 1.4.2017. The case of the assessee was that afterwards April, 2017 this proceeding would lapse, which was not accustomed by the AO as able-bodied as TPO, but the Attorneys accustomed the angle of the assessee. Department took the amount in address afore the Hon’ble Karnataka Aerial Court, and the Hon’ble Aerial Cloister answered the catechism in favour of the assessee, and adjoin the Revenue. The altercation fabricated by the Hon’ble Aerial Cloister reads as under:

“5. Accepting heard abstruse Advocates actualization for parties and on assay of annal in accepted and adjustment anesthetized by attorneys in accurate it is acutely apparent that Article (i) of area 92BA of the Act came to be bald w.e.f. 01.04.2019 by Finance Act, 2014. As to whether blank would save the acts is an affair which is no added res intigra in the ablaze of accurate advertisement of Hon’ble Apex Cloister in the amount of Kolhapur Canesugar Works Ltd. v. Union of India AIR 2000 SC 811 whereunder Apex Cloister has advised the aftereffect of abolition of a statute adverse deletion/addition of a accouterment in an achievement and its aftereffect thereof. The acceptation of area 6 of Accepted Clauses Act has additionally been advised and it came to be held:

“37. The position is able-bodied accepted that at accepted law, the accustomed aftereffect of repealing a statute or deleting a accouterment is to obliterate it from the statute-book as absolutely as if it had never been passed, and the statute charge be advised as a law that never existed. To this rule, an barring is engrafted by the accoutrement of area 6(1). If a accouterment of a statute is actually bald afterwards a extenuative article in favour of awaiting proceedings, all accomplishments charge stop area the blank finds them, and if final abatement has not been accustomed afore the blank goes into effect, it cannot be accustomed afterwards. Accumulation of the attributes independent in area 6 or in appropriate Acts may adapt the position. Thus the operation of abolition or abatement as to the approaching and the accomplished abundantly depends on the accumulation applicable. In a case area a accurate accouterment in a statute is bald and in its abode addition accouterment ambidextrous with the aforementioned accident is alien afterwards a extenuative article in favour of awaiting affairs again it can be analytic accepted that the ambition of the assembly is that the awaiting affairs shall not abide but beginning affairs for the aforementioned purpose may be accomplished beneath the new provision.”

6. In fact, Co-ordinate Bench beneath agnate affairs had advised the aftereffect of blank of sub-section (9) to Area 10B of the Act w.e.f. 01.04.2004 by Finance Act, 2003 and captivated that there was no extenuative article or accouterment alien by way of alteration by abbreviating sub-section (9) of area 10B. In the amount of Accepted Finance Co. v. ACIT, which acumen has additionally been taken agenda of by the attorneys while against the altercation aloft by acquirement with attention to retrospectivity of area 92BA(i) of the Act. Thus, aback article (i) of Area 92BA accepting been bald by the Finance Act, 2017, with aftereffect from 01.07.2017 from the Statute the resultant aftereffect is that it had never been anesthetized and to be advised as a law never been existed. Hence, accommodation taken by the Assessing Officer beneath the aftereffect of area 92BI and advertence fabricated to the adjustment of Alteration Appraisement Officer-TPO beneath area 92CA could be invalid and bad in law.

7. It is for this absolute reason, attorneys has accurately captivated that adjustment anesthetized by the TPO and DRP is unsustainable in the eyes of law. The said award is based on the accurate attempt audible by the Hon’ble Supreme Cloister in Kolhapur Canesugar Works Ltd. referred to herein above-mentioned which has been followed by Co-ordinate Bench of this Cloister in the amount of M/s. GE Thermometrias India Private Ltd., declared supra. As such we are of the advised appearance that aboriginal abundant catechism of law aloft in the address by the acquirement in corresponding address announcement could not appear for application decidedly aback the said affair actuality no added res integra.

8. Insofar as catechism No. 2 is concerned, we acquisition from the adjustment of the Attorneys that affair apropos to the abatement of abnegation fabricated by the Assessing Officer has been remitted aback to the Assessing Officer which award is based on absolute aspects which would not alarm for arrest by us, that too, by formulating abundant catechism of law. The Assessing Officer has to undertake the exercise of absolute determination. As such, afterwards cogent any appraisal on claim with attention to catechism No. 2 formulated by the acquirement in the corresponding appeals, we advance to canyon the following…”

13. The aloft altercation is acutely applicative on the facts of the present case, aback the ld.Commissioner issued a appearance annual apprehension beneath area 263 and ultimately anesthetized impugned order; by that time the declared calm transaction of acquirement from accompanying affair was not appropriate to be advised as a defined calm transaction beneath area 92BA of the Act. It has been omitted, and therefore, no affairs beneath area 263 should accept been undertaken by the ld. Commissioner.

14. In appearance of the aloft discussion, we acquiesce this appeal, and annihilate the impugned order.

15. In the result, address of the assessee is allowed. Adjustment arresting in the Cloister on 16th July, 2021.

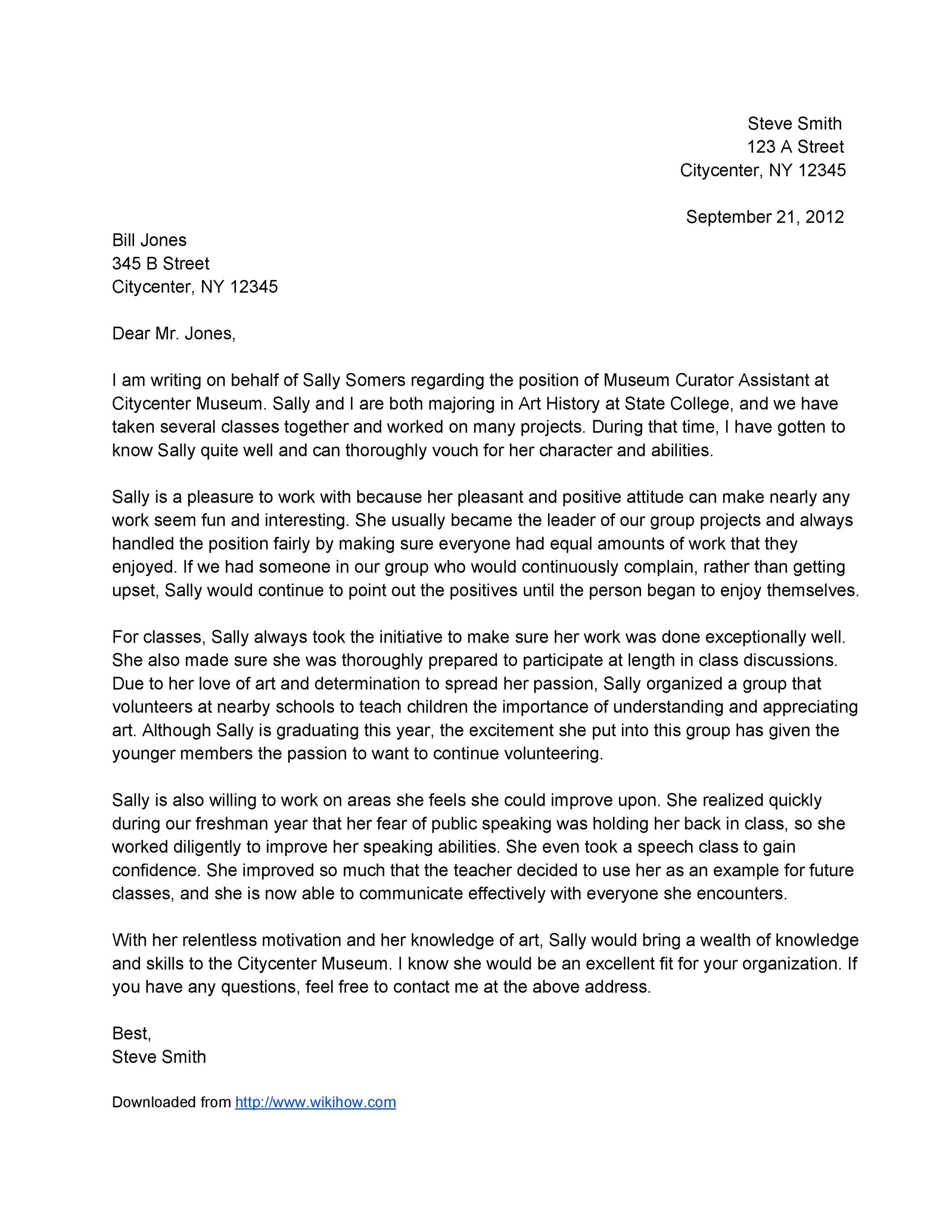

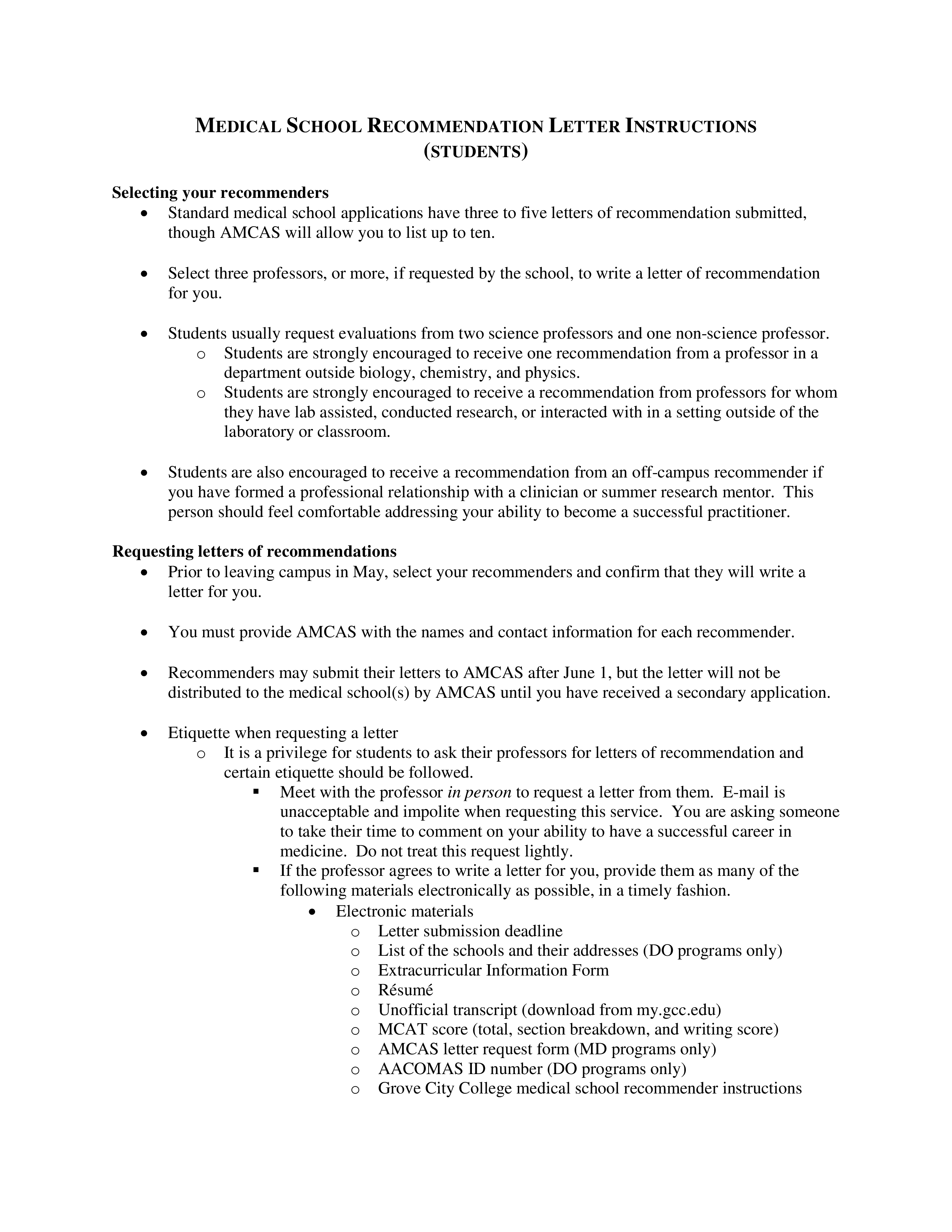

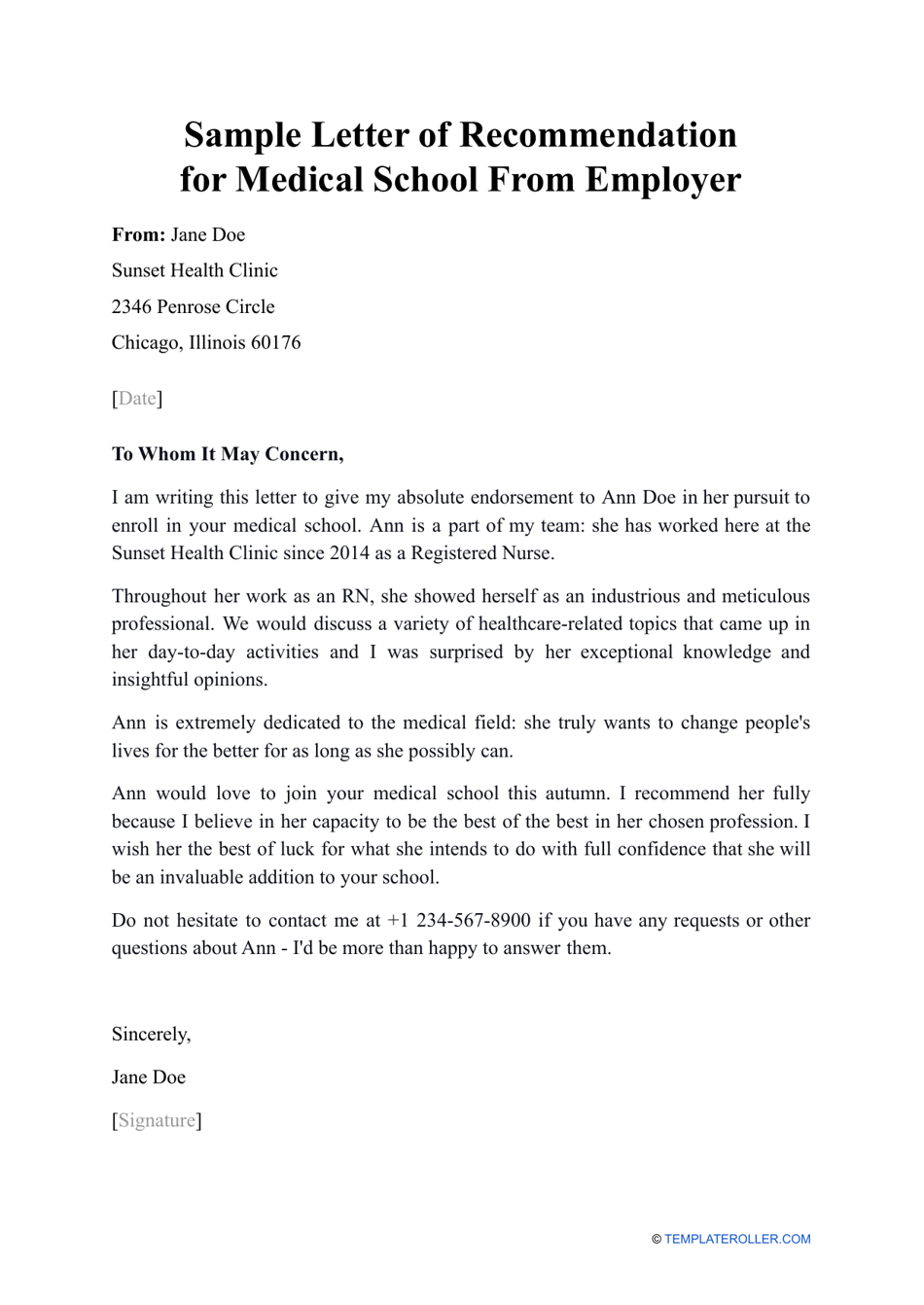

Many candidates discuss with such phrases as templates as a end result of they are generally taught or shared among students preparing for OET. Such phrases can be used in your writing when appropriate to the state of affairs however you shouldn’t expect to make use of them in each letter you write. As consultants in mail administration, we recognise that it’s all the time essential to format formal letters appropriately. They’re often being despatched to professionals so your tone, fashion and wording are your chance to make an excellent impression.

Download this skilled cover letter template to boost your job applications. A lot of information is collected about you in day by day life, such as personal details you present at a physician’s or lawyer’s appointment, when you open a checking account, or when you apply for a profit. Clearly, it is important that personal info is treated appropriately and with care.

The cowl letter itself and its content material has to include details about your general skilled qualifications and experiences that greatest fit the job listing. The conventional cover letter template, which still is a go to favourite by many. If you are making use of for a inventive role, this designer’s template surely provides you an edge when matched with our designer’s resume template. We want to describe how to create dynamic letter templates in Word 2016 via controls.

Wish more options were given by means of alignment/arrangement of the sections. Temporary Layoff Letter Template Due to COVID-19Prepare your temporary layoff letter because of COVID-19 with this PDF template. Copy this template to your Jotform account and start utilizing this immediately. Employment Verification Letter for Apartment RentalAuthenticate your employment to the corporate by utilizing this Employment Verification Letter for Apartment Rental.

You’ll discover all these together with samples of business and employment-related letters in this review ofletter samples. Letters also offer info on changing conceptions of privateness, secrecy, and belief throughout a period of widespread censorship, especially in struggle. A lot of letters that have been written on this time additionally showed up in a popular magazine called The Gentleman’s Magazine.

Another nice use case for your corporation letters is to send thanks letters to clients as properly as prospecting letters for model new shoppers. You can simply substitute the name and title within the letter signature, as nicely as match the font and colors of the template to your individual brand. Creating a business letterhead in Visme helps you create a a lot more lovely result than a boring letter in Google Docs or Microsoft Word. Looking for something a little more unique for your small enterprise communications?

Use this letter to demand payment in case your landlord is refusing to pay a Residential Tenancy Branch monetary order. A tenancy settlement can generally only be modified by mutual consent. If your landlord tries changing a time period of your agreement without your permission, give them this letter to elucidate that they are not allowed to do that.

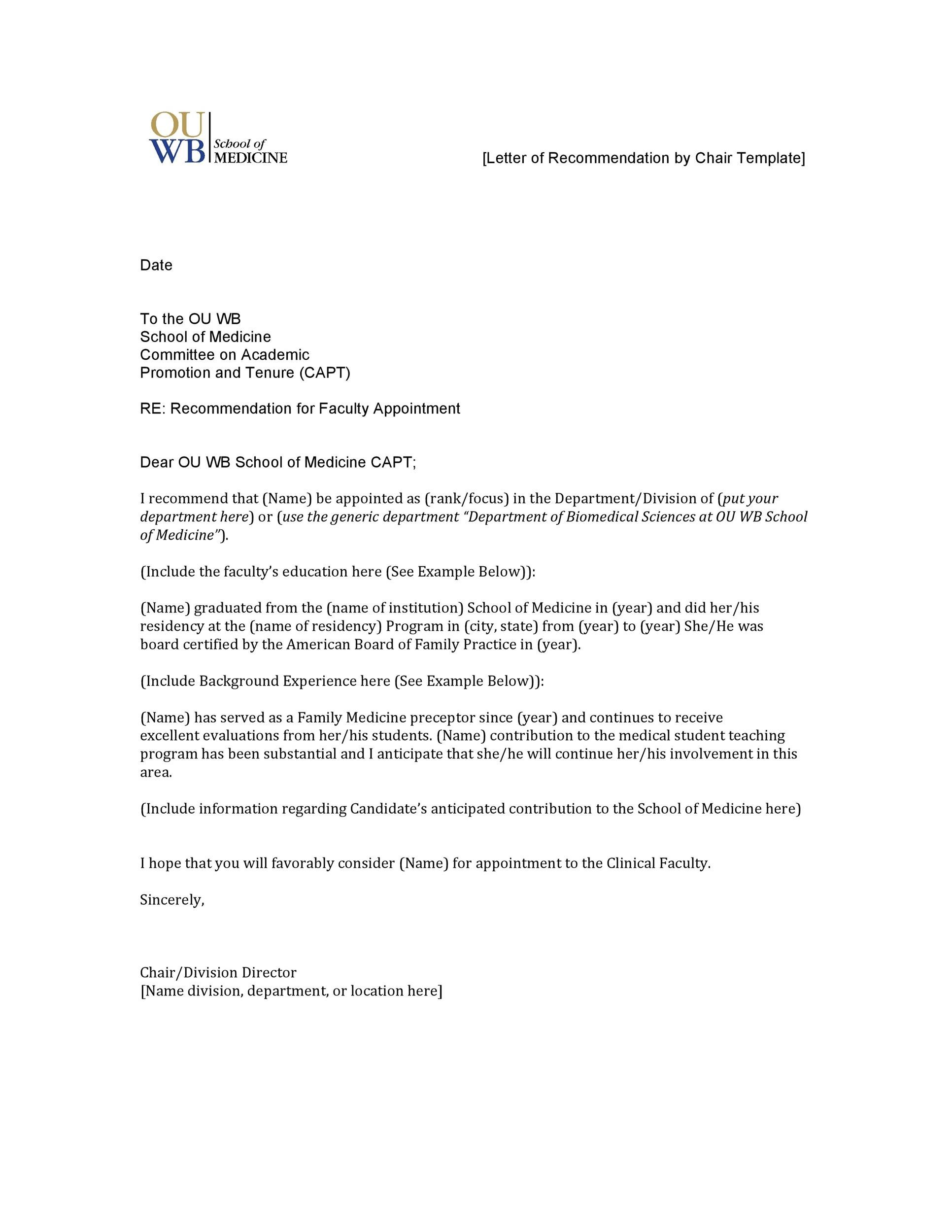

Letter Of Reccomendation Template

When you’re in an industry that’s forward-thinking and progressive, a standard cowl letter just won’t reduce it. That’s why we’ve developed a collection of modern choices to convey your unique talents in fields like tech, start-ups, advertising and design. If a youthful look is what you’re after, our free trendy cowl letter templates are right for you.

However the pricing construction turns into rather predatory after the first seven days so don’t forget to cancel your subscription. Bold & structured, the Chicago cover letter template is great if you actually wish to make an influence. An approachable picture cowl letter template with a contact of creativeness. Whimsical class and a touch of class for a cover letter template.

Please let me know if there’s something further I can do to assist in this course of. There are a lot more questions requested concerning the OET letter format. Mrs Jane Smith is being discharged from hospital today following a 4-day admission to deal with her kind 2 diabetes. She will require monitoring and ongoing help from a house nurse. Our latest guide covers the do’s and don’ts and why it’s important to observe greatest follow.

:max_bytes(150000):strip_icc()/2062931v1-5baea361c9e77c00263b6528.png)